Without THIS Critical Skill, Access to Great Deals and Money Are Practically MEANINGLESS!

The critical skill is "underwriting" - the ability to analyze the numbers and know if your deal's a good one or not. Underwrite Right™ makes it easy to master professional underwriting fast, so you never buy a bad deal.

In real estate, you make money by buying deals right. It’s analyzing the property, based on its actual past performance, to tell you whether it’s really worth what the seller’s asking for it.

That’s underwriting.

It’s analyzing the property, based on its actual past performance, to tell you the true value and whether it’s really worth what the seller’s asking for it.

And Underwrite Right™ shows you exactly how to underwrite properly, step-by-step, so it’s easy to understand.

Whether you’re completely new to underwriting or have done a few deals already, Underwrite Right™ shows you how to get your underwriting correct every time.

Underwriting Wrong --> Bad Deals and Lost Money

New investors often ignore underwriting right.

They trust the broker’s or seller’s claims about how the property will perform in the future.

They use irrelevant rules of thumb meant for Single Family Rentals.

Or they “underwrite,” but they’ve been misled by a guru about what numbers to use.

Failing to Underwrite Right leads them to miscalculations.

Miscalculations lead to . . .

All of which lead to the same place - poor returns, lost income, and even outright foreclosure and the loss of your entire investment.

So, why do new investors underwrite wrong or ignore it altogether?

Because they rely on the wrong numbers. Or they think it’s too hard. Or they’re intimidated by it.

But they really shouldn’t be.

Because underwriting is straightforward, if you know how to do it.

And teaching you how to do it right is what Underwrite Right™ is all about.

Underwriting Shouldn’t Be Intimidating -

It Should Be Fun!

Many new investors are confused, intimidated and overwhelmed by underwriting.

No wonder. If you’ve never done it before, you don’t know where to start, and you probably have questions swirling around your brain, like:

- How do I know this deal is really a good one?

- Should I trust what the broker says about the property?

- Should I rely on actual numbers or my own estimates or on rules of thumb?

- What materials do I need from the seller and how do I get them?

- How do I know what income the property will produce?

- How can I estimate the expenses I will pay?

- What will the closing costs be?

- How will mortgage interest rates and terms affect my returns?

- How much equity do I really need to close the deal?

- How can I tell if the seller’s numbers are fudged?

- What numbers should I use if the seller’s numbers are fudged - or just missing?

- It’s enough to make your head spin.

But it shouldn’t.

Underwriting should be straightforward.

And, frankly, it should be fun.

(I love running the numbers and seeing how much I might be able to make on a deal, if I can get it for the right price - and good underwriting tells you what the right price is.)

And that’s what my Underwrite Right™ program does for you.

Taken directly from my acclaimed Multifamily Launchpad real estate investment program, Underwrite Right™ walks you through underwriting in a step-by-step, easy-to-follow method that takes all the confusion and intimidation out of underwriting.

So you can underwrite deals like a pro.

Be confident that the good deal you found really is a good deal.

And have the fun that comes with knowing what you’re doing, so you can focus on the money you might make investing rather than whether you’re “doing it right” or not.

NEVER GET KNOCKED OUT BY THE NUMBERS AGAIN WITH

Underwrite Right™

Underwrite Right™ is the comprehensive roadmap for multifamily real estate investors of any experience level to start underwriting deals like a pro and gain the investing confidence - and profitability - that comes with it.

Inside Underwrite Right™, you get the full underwriting portion of my Multifamily Launchpad investment program, including:

01

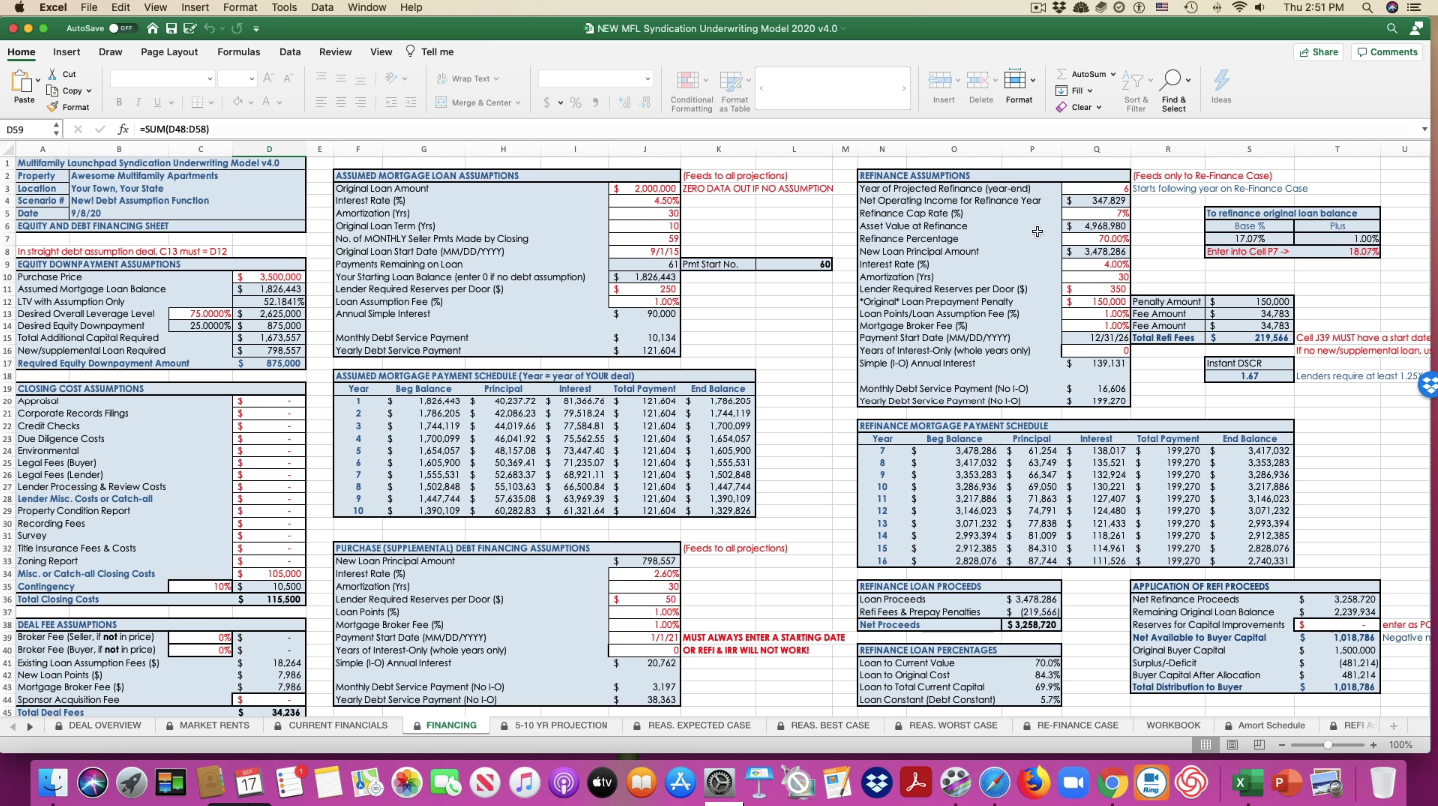

The Multifamily Launchpad Syndication Underwriting Model 4.0: my easy-to-master underwriting model that gives you professional-level analysis with just a few inputs - the actual model I use in my own deals.

02

The ability to underwrite deals as a single investor or as a multi-investor syndication, with the full cash-flow waterfalls showing what each party will get.

03

Over-the-shoulder video instructions on using the Underwriting Model, so you understand exactly how to use it before you get started.

04

Precise instructions on which materials you need from the seller, so there’s no guesswork and you know if a seller has withheld vital information

05

Step-by-step instructions on using a property’s financials to accurately forecast income

06

Step-by-step instructions on forecasting the property’s expenses - including which seller expense items you can safely rely on and which you must forecast yourself, and how to do it

07

Instructions on underwriting the debt financing, deal expenses, and initial capital expenditures, so you can calculate the correct amount of equity you need and accurately forecast your returns

08

My method to “predict the future” and make reasonable cash flow and exit projections, so you can forecast how much cash the property will generate before you buy

09

My scenario planning and stress-testing methodology, so you can calculate break-evens and worst-case scenarios, and understand exactly how much risk you’re taking on at any given sale price

10

A full, over-the-shoulder video underwriting example using one of my properties, so you can see exactly how I underwrite my own multifamily real estate deals

11

The actual underwriting materials you need to study and re-create my over-the-shoulder underwriting example, so you can immediately start underwriting your own deals with confidence

No Need to Create Your Own Underwriting Model -

Because It’s Already Right Here!

When I started investing in Multifamily real estate, I had to create my own underwriting model, because I couldn’t find anything affordable that gave me what I needed to underwrite deals the right way.

But many new investors don’t know how to create their own model, or they’re afraid to try because they might screw it up.

And that leads them to use simplistic “rules of thumb” that are destined to lead them astray, because they’re meant for Single Family Rentals and aren’t applicable to Multifamily deals.

Or new investors ignore underwriting altogether and rely on the broker’s rosy, pro forma projections, which are designed to make buyers overpay for deals.

What the Experts Are Saying...

Joe Fairless

Host of the Best Real Estate Investing Advice Ever Podcast

He is the real thing

As a real estate investor, consultant, and host of a successful real estate podcast, I know the real estate field, and I know a real expert when I see one. I've known Jonathan Twombly since I first got started in this business, and he is the real thing.

Gino Barbaro

Co-Host of The Wheelbarrow Profits Podcast with Jake & Gino

Impressed with Jonathan's skill and savviness

I am impressed with Jonathan's skill and savviness in the multifamily space and I continue to learn from him.

Michael Zuber

Author and podcast host, One Rental at a Time: The Journey to Financial Independence through Real Estate

The only one choice

I wanted to add a Multifamily expert to my podcast because it’s an important topic for my audience to understand. When I thought about who would provide them the best advice, independent of market hype, there was really only one choice - Jonathan Twombly.

Reed Goossens

Podcast host and author, Investing in the U.S.: The Ultimate Guide to U.S. Real Estate

One of the best multifamily investors

[Jonathan] stands out as one of the best multifamily investors, and teachers, in the industry.

John Cohen

JC Property Group LLC

Really knows what he's talking about

As a former commercial broker and now the owner of 1,300 apartment units, I know real estate investment as well as anyone. You come across few people in this field who really know what they're talking about. Jonathan is one of them.

100% Satisfaction Guaranteed

Secure Payment

Includes my battle-tested

Underwriting Model

To invest successfully in Multifamily, you must have a reliable underwriting model. And, with Underwrite Right™, there’s no need for you to create one from scratch.

Because, inside the program, you get my professional-level Multifamily Launchpad Syndication Underwriting Model 4.0 as part of the program.

It’s the actual model I use to underwrite my own deals. The one I’ve continually upgraded over the years to account for changes in the multifamily business.

It’s an easy-to-use, yet robust model that allows you to:

- Forecast future rents from just one month’s rent roll

- Compare your own projections with the seller’s last full year financials; the seller’s trailing-3, -6, or -12 financials; and the broker’s pro-forma projections - side-by-side on a single page

- Underwrite almost any kind of financing scenario, including:

- Straight purchase-money mortgages, with or without interest-only periods

- Mortgage assumptions

- Mortgage assumption + supplemental mortgage financings

- Refinancing

- Preferred equity financing, and

- Syndicated limited partner equity

- Automatically generate single-investor (i.e., you only) and syndicated deal waterfalls, so you can compare returns across both types of deals side-by-side

- Automatically generate total return and IRR projections for 5-year and 10-year hold periods, and compare them side-by-side, without having to toggle between or re-create the wheel

- Easily adjust your asset management fees, preferred returns, and sponsor participation percentages to create different investor return scenarios

- Generate reasonable-case, best-case, and worst-case scenarios, and compare them side-by-side without having to create a new spreadsheet or change your base assumptions.

- Easily compare refinancing scenarios against non-refinancing scenarios side-by-side without having to change your base assumptions or start a new spreadsheet

- And adjust the model to fit your changing needs as you advance in the multifamily investing business

See Underwrite Right™

in action here

See Underwrite Right™ in action here

When I started out, I did underwriting wrong, too -

But I learned to Underwrite Right™

... and I’m passing those lessons on to you

I nearly botched my first multifamily deal, because I didn’t know how to underwrite right. I knew how to create a model. I knew how to plug in numbers so the model spit out a result.

But I used the wrong numbers.

“Put garbage in, get garbage out,” as the computer programmers used to say about putting bad data into a good program.

See, I had listened to gurus say to “underwrite on actuals” - meaning, ignore the broker’s pro forma projections and use the seller’s actual numbers.

So I did exactly that. And thought I was doing the right thing.

I thought I was buying a great deal at a great price.

But I didn’t understand that relying on the seller’s numbers made the property look like it would be more profitable under my operation than it actually was.

Leading me to overpay for it.

And causing years of headaches, lost sleep, and angry investors.

So, if you can’t rely on the seller’s past financials, and you shouldn’t rely on the broker’s future projections, what are you supposed to rely on?

That’s exactly what you learn inside Underwrite Right™. You'll be confident in your numbers and avoid overpaying for deals right from the start.

You Won't Find ANYTHING This Comprehensive At This Price Anywhere Else

Underwriting models this good can cost you hundreds of dollars if purchased elsewhere.

Or they’re sold as recurred-billing SAAS products, where you lose access to the model if you stop paying your monthly subscription fee.

Plus, these models assume you already know how to underwrite multifamily property.

They don’t come with an in-depth video instruction program designed for you to start at zero and quickly learn to Underwrite Right™.

And, if you know me at all, you know that my mission is to provide high-quality real estate education at a reasonable price.

Because I think this information should be available widely, and not just to the people who can afford to pay the gurus’ highway-robbery prices.

Normally, to get this material, you’d have to purchase my entire Multifamily Launchpad course for $1,497 - already a bargain given what’s inside.

Or you’d have to join my private mentoring group, where you’d have access to the materials only as long as you continue to pay your monthly membership access fee.

But now, for this special offer, you can have the full Underwrite Right™ program AND the Multifamily Launchpad Syndication Underwriting Model 4.0, with all its functionality,

For a one-time payment of just $197.

100% Satisfaction Guarantee

The Underwrite Right™ program is so power-packed, and the Multifamily Launchpad Syndication Underwriting Model 4.0 is so easy to use -

That you can easily start

underwriting like a pro in 14 days or less!

In fact, I’m so confident that Underwrite Right™ is the best Multifamily underwriting program out there that, if you complete the program videos within 14 days and you aren’t completely satisfied, then I’ll refund your full purchase price, no questions asked.

Here's EXACTLY What's Inside

Underwrite Right™

You get my full, step-by-step video course showing you everything you need to start and scale a successful multifamily real estate business. Nothing is left out, no stone left unturned. The video course contains these 11 modules:

1

The Multifamily Launchpad Syndication Underwriting Model 4.0

2

Video 1: Introduction - What to expect in the program

3

Video 2: What You Need to Underwrite Deals

Exactly what materials you need to underwrite properly and where to get them

4

Video 3: Introduction to the Multifamily Launchpad Syndication Underwriting Model

A step-by-step walk through the basic underwriting model I use in my own deals

5

Video 4: Basic Underwriting - Income

How to underwrite your property’s future income accurately and confidently from just a single month’s rent roll

6

Video 5: Basic Underwriting - Expenses

Why underwriting on “actual numbers” can sometimes lead to big mistakes; when to rely on the property’s financials and when to use your team’s knowledge to forecast your property’s future expenses accurately

7

Video 6: Basic Underwriting - Financing, Deal Expenses, and Initial Capital Expenses

How you underwrite your mortgage, plus the deal expenses and initial capital costs that new investors usually overlook, causing them to underfund their deals, causing hardships down the road

8

Video 7: Basic Underwriting - Pro Forma Projections and Exit Assumptions

How you underwrite your future pro forma projections and exit assumptions so you can confidently calculate your property’s overall returns

9

Video 8: Basic Underwriting - Scenario Planning and Stress-Testing

Particularly important during times of economic turbulence, this video shows how to use the model to stress-test your property and make sure that it will survive an economic downturn

10

Video 9: Basic Underwriting - Addison Townhomes 2018

You get an over-the-shoulder view as I underwrite one of my own properties, showing you how I approach the underwriting process

11

Video 10: Introduction to the New Multifamily Launchpad Syndication Underwriting Model

How to underwrite debt refinancing to increase your property’s returns

12

Video 11: Underwriting Debt Assumptions

How to underwrite a deal when you must assume existing financing, whether you can add a supplemental mortgage or not

13

Video 12: Structuring a Deal with Preferred Equity

How to add a layer of preferred equity to your deal and enhance the returns to the common equity LPs

Master Underwriting Now

Underwrite Right™ In Just 14 Days!

Multifamily real estate is one of the best ways to create and grow your wealth for the long term.

And, if you’re serious about Multifamily real estate investing, then you must master the art of underwriting properties.

There’s no way around it: you must learn to underwrite right.

And there’s no better way to do that quickly, than with my Underwrite Right™ multifamily real estate underwriting program.

And, if you purchase right now, you’ll get

- The entire Underwrite Right™ video course, previously available only to people who purchased the full Multifamily Launchpad investing course or joined my private mentoring program, and

- The 14-Day satisfaction-guaranteed money-back guarantee, and

- The fully-upgraded Multifamily Launchpad Syndication Underwriting Model 4.0, with all its robust functionality - yours to keep as my gift, even if you cancel

All for a one-time payment of just $197.

This offer is subject to be withdrawn at any time without notice. So don’t miss out. Join now!

Terms and conditions apply.

What My Students Say....

Rusty Symes

MFL Student

Everything you said was correct.

I’ve tried my hand at multifamily investing. I couldn’t get past dealing with brokers. And yes, I have taken several courses. . . . I followed your instructions to a Tee . . . [and] a top broker . . . added me to his selective buyers list. Everything you said was correct.

Joe Ely

Finance Professional,

Charlotte, NC

Genuinely wants us all to succeed

Jonathan is a born teacher. He loves to instruct people to share his knowledge, and he is very encouraging with us as students….he genuinely wants us all to succeed.

Christina Potosnak

Realtor and Investor,

Greenville, SC

Information that he gives is wonderful

Jonathan is … one of the genuine individuals that really just wants to help people.… We really trust his opinions and the information that he gives is wonderful.

Liam Barnes

Software Professional,

New York, NY

Very truthful and honest

Jonathan is very truthful and honest about what the realities are of getting into your first deal…. Jonathan is a great teacher and a great mentor.

Garrett White

Nuclear Engineer,

North Carolina

Goes above and beyond

[Jonathan] adds tons of insight and tons of value, and if he can’t answer something for whatever reason, he goes above and beyond to make sure he gets you in touch with someone who can.